Household renovations and building work are among the most typical spends for it form of financial support. Make use of brand new collateral of your home to pay for do it yourself. So it boosts the worth of the home, it is therefore similar to using security for more collateral.

Usually talk to a professional before you make the decision to supply the collateral. If you would like make use of this solution, i encourage an instant, private session which have a counselor to consider the choices. Name (844)-402-3073 to help you demand good HUD-approved free appointment.

Explore #2: By taking currency obtain

It might seem uncommon, you could explore domestic equity funds to help you strategically invest their money. In case the price of get back is higher than the speed to your loan, then it should be a smart choice. Which only works whenever financial costs are reasonable as well as the financing marketplace is solid.

It is also worthy of detailing your acquire to blow concept doesn’t require you to definitely rely on equity. You could potentially take out a keen unsecured consumer loan accomplish the fresh same task.

Use #3: Safeguards degree will cost you

Education loan loans would be an enormous weight. Its among the merely types of financial obligation you cannot with ease discharge by way of bankruptcy. The federal government can garnish your wages and you will taxation refund or levy your loan places Park Center bank account. And monthly obligations can be consume your finances when you have limited income.

This is exactly why people explore equity to fund degree will cost you. You could take-out this new collateral financing prior to school to help you shell out university fees or any other will set you back physically. You are able to make use of the security to pay off their beginner money. You need to be mindful this doesn’t put financial balances at stake.

Play with #4: Enhance an urgent situation loans

For those who have a major costs that comes right up you cannot protection with coupons, you can utilize property security loan otherwise HELOC to provide the bucks you prefer. It is better option than just taking right out an online payday loan one might have money fees over 300%. Yet not, its a much better suggestion to possess deals serve as your crisis money. Setting aside cash mode there is no need a lot more money to fund a significant expense.

Use #5: Pay off credit debt

The last cause some one are not take-out family equity financing was to possess personal credit card debt payment. For those who have a large level of personal credit card debt in order to repay, a property equity loan may seem like a feasible services. But not, they many cases the brand new prize isnt worth the risk inside the this situation.

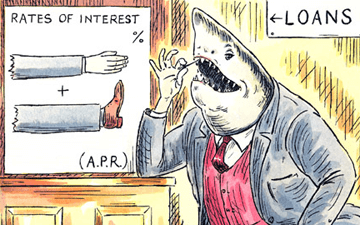

Playing cards keeps notably higher interest rates most cards has rates about highest kids or twenties. In comparison, property guarantee loan or HELOC create typically have a much straight down rates. The issue is which you sign up for a secure loan to help you pay off personal debt. Which rather grows their chance.

Handmade cards are un-secured debts. This means there is no security affixed your debt. Up to a collector you are going to threaten you, they can not in reality take your possessions without a civil court judgment. Put differently, they must sue you.

But if you use a collateral financing to pay off your credit cards, now your debt is secure. If you can’t repay the loan, you could be susceptible to property foreclosure. By using from the loan, you enhanced your own exposure in such a way that’s not often worthy of the fresh new get back.

Next profiles helps you better know how collateral finance interact with most other investment choice. This can help you generate a great deal more advised conclusion when selecting new right financing systems for your requirements.